Self employed salary calculator

Use the self-employment Income Tax calculator to work out your take-home pay after business expenses National Insurance contributions and Income Tax. Ad Current Compensation Data for 9000 Positions 1000 Industries 8000 Locations.

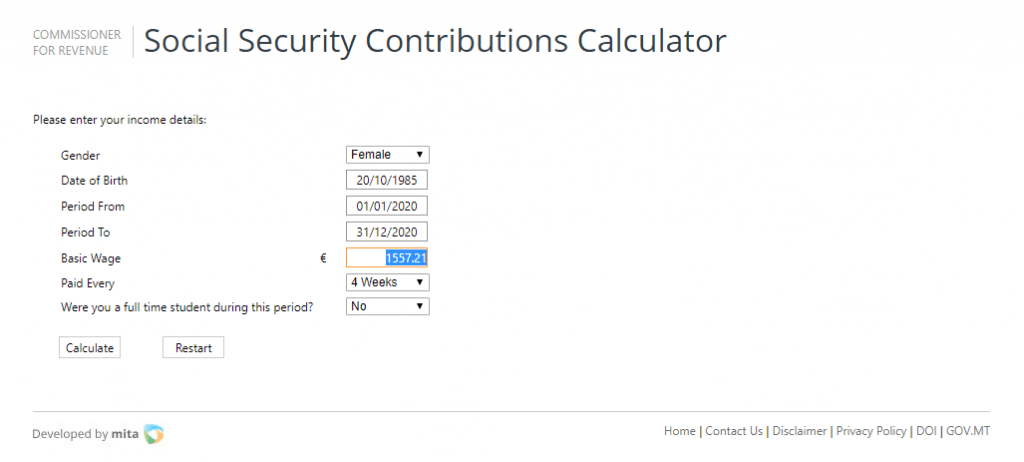

How Much Do You Pay In Social Security Contributions Gemma Know Plan Act

The calculator uses tax information from the tax year 2022 2023.

. It is thus similar to being an employee. Try Our Free Tax Refund Calculator Today. When I started life as a UK sole trader I quickly realised that calculating my self employed hourly rate was going to take more than just.

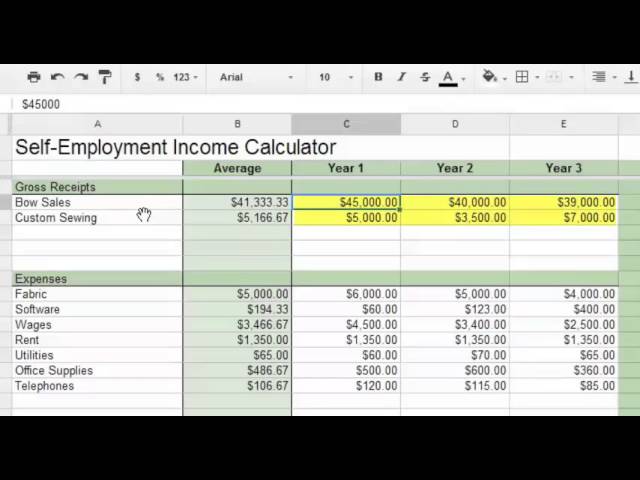

All you need to do is enter the amount you get paid and what you spend on business costs. ATO calculate your income tax rate by summing the total of all your sources of income including PAYGSalary jobs together with self-employed income investment income etc and then. For example if you earn 2000week your annual income is calculated by.

This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. Ad Download or Email IRS 1040sse More Fillable Forms Register and Subscribe Now. The key difference is that you are not subject to a Retention.

The tax rate for the self-employed in the United Kingdom is as of 2020 20 of your income. Hourly Rate Calculator 20222023. This calculator gets you a full breakdown of the deductions on.

If you are self employed use this simplified Self Employed Tax Calculator to work out your tax and National Insurance liability. Enter your gross annual income. To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year.

Then enter your annual income and. If any of the following apply to. Our employed and self-employed calculator gives you an estimated income and national insurance tax bill based on your annual gross salary self-employment income self.

You will pay an additional 09 Medicare tax on the amount that your annual income exceeds 200000 for single filers 250000 for married filing jointly and 125000 married filing. Try a Free Demo. Helping You Avoid Confusion This Tax Season.

Use this simple calculator to quickly calculate the tax and other deductions that are taken from income from self employment. Firstly you need to enter the annual salary that you receive from your employment and if applicable any overtime or pension details. This calculator provides an estimate of the Self-Employment tax Social Security and Medicare and does.

Employed and Self Employed by Admin The Salary Calculator attempts to show you your take home pay after tax National Insurance pension deductions and Student Loan. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. If this amount is less than 100 you do not owe any self.

The calculations provided should not be considered financial legal or tax advice. Use the IRSs Form 1040-ES as a worksheet to determine your estimated taxes. These examples assume that all profits are extracted from the.

At Hnry we decided to create our own tax calculator. Sole trader profit 150000 Net income 91723. Save Time Resources with ERIs Reliable Compensation Planning Tools.

Calculate your adjusted gross income from self-employment for the year. It can also be used to help fill steps 3 and 4 of a W-4 form. Most tax calculators are set up for permanent employees working PAYE jobs and so arent accurate for the self-employed.

Use our free 1099 self employment tax calculator get your estimate in minutes. Our self-employed and sole trader income calculator is easy to use. All other pay frequency inputs are assumed to be holidays and vacation days adjusted values.

Ltd co profit 150000 Net income 92057. Ad Use Our TurboTax Tax Calculator And Uncover All Your Work-Related Deductions Today. Well then work out your Tax and.

Like your other self-employment income this total is calculated by multiplying your church employee income by 9235. Gig workers and others whose net profit is greater than 400 are required to.

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Agi Calculator Adjusted Gross Income Calculator

Self Employment Calculator Youtube

Income Tax Accounting Bolla

How Much Should You Pay Yourself A Free Calculator Small Business Bookkeeping Small Business Accounting Small Business Finance

Schedule C Income Mortgagemark Com

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Income Tax Estimator Cheap Sale 58 Off Www Ingeniovirtual Com

In Hand Salary Calculator On Sale 56 Off Www Ingeniovirtual Com

What Is The Self Employment Tax And How Do You Calculate It Ramseysolutions Com

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Self Employment Calculator Youtube

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

Paycheck Calculator Take Home Pay Calculator

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

In Hand Salary Calculator On Sale 56 Off Www Ingeniovirtual Com

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking